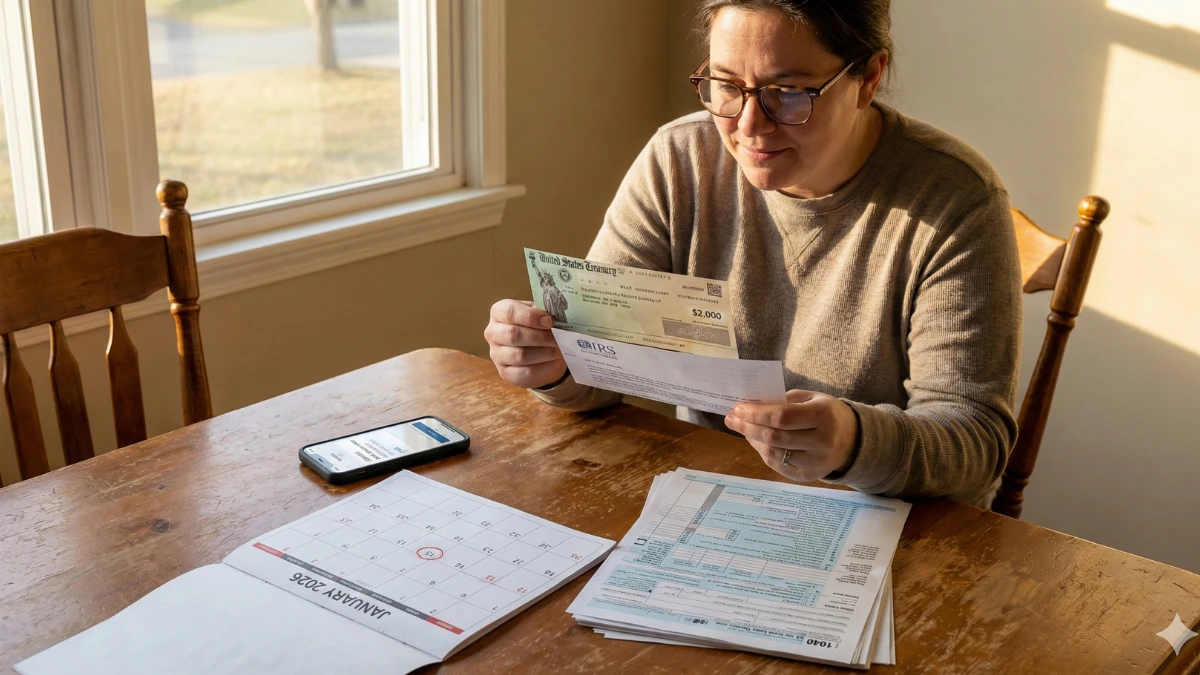

News about a federal $2,000 deposit arriving in January 2026 combined with claims that the IRS has confirmed payments is creating confusion, because this amount is not a guaranteed benefit for everyone but instead reflects individual tax refund outcomes, credits, or adjustments that depend on eligibility, filing accuracy, and timing.

What the IRS Confirmation Actually Refers To

The Internal Revenue Service has not approved a universal $2,000 payment, and any January 2026 deposits near this amount come from tax refunds, refundable credits, or reconciled overpayments issued after a return is filed and accepted.

Federal $2,000 Deposit Status Overview

| item | reality |

|---|---|

| universal payment | no |

| source of funds | tax refund or credit |

| eligibility | individual filing-based |

| january 2026 | early processing window |

Who May Be Considered a Beneficiary

Beneficiaries likely to see amounts near $2,000 include taxpayers with higher withholding, refundable credits, dependents, or corrected filings, while others may receive smaller or larger refunds based on income, filing status, and credit limits.

New January 2026 Payment Dates Explained

Refunds for eligible filers may begin arriving in January 2026 for those who e-file early and choose direct deposit, though W-2 matching, identity checks, and credit reviews can push some payments into later weeks.

Why Some Deposits Change After Review

Refund amounts can change after IRS verification of income records, identity protection checks, or credit eligibility, which may adjust the final approved deposit before release.

How Beneficiaries Can Avoid Delays

Waiting for all W-2s, filing accurately, choosing direct deposit, and monitoring official IRS refund tools are the best ways to ensure any approved federal deposit is issued without unnecessary holds.

Key Facts Beneficiaries Must Know

- no universal $2,000 federal payment exists

- refund amounts vary by filer

- early e-file gets priority

- verification affects timing

- irs approval controls release

Conclusion

The federal $2,000 deposit for January 2026 reflects a possible tax refund result, not a guaranteed payment, and beneficiaries should focus on eligibility, filing accuracy, and timing to understand if and when funds may arrive.

Disclaimer

This article is for general informational purposes only and explains IRS refund-related claims; individuals should rely on official IRS communications for confirmed eligibility, amounts, and payment dates.