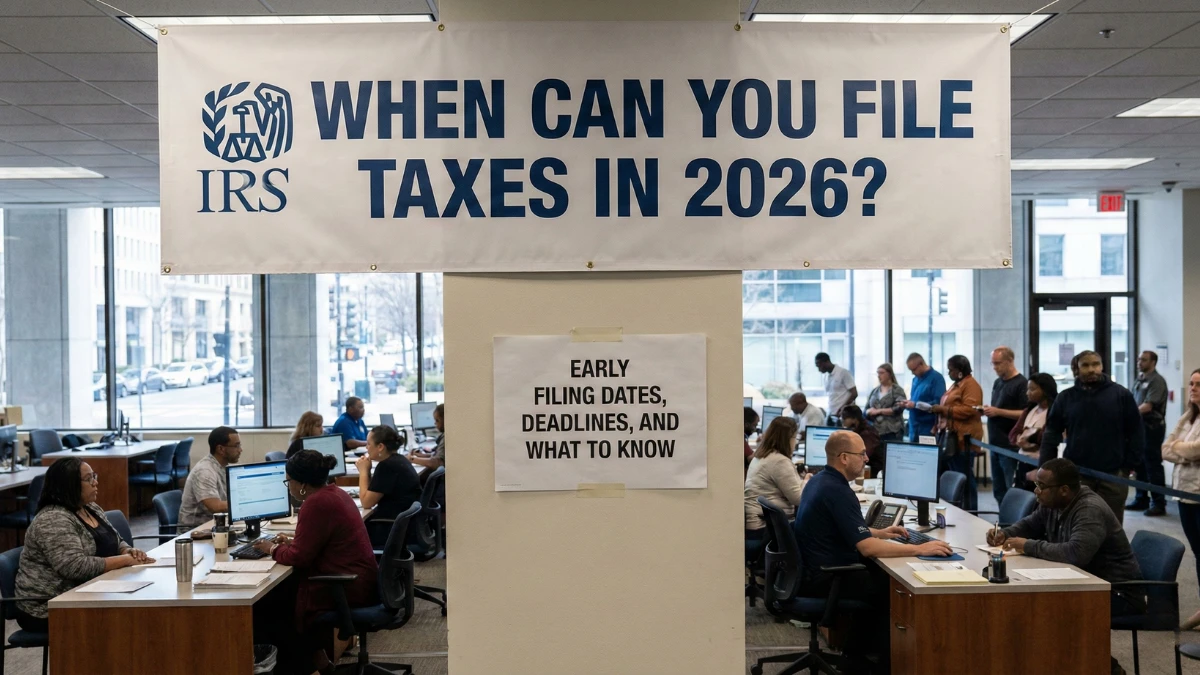

IRS W-2 Timing in 2026: Why February Dates Can Make or Break Your Refund Plan

In 2026, W-2 timing is becoming a major factor in refund planning, because February employer filing dates directly affect IRS matching, refund approval, and how quickly taxpayers see direct deposits, especially for those expecting early refunds. Why W-2 Timing Matters More In 2026 The Internal Revenue Service relies on employer-submitted W-2 data to verify wages … Read more