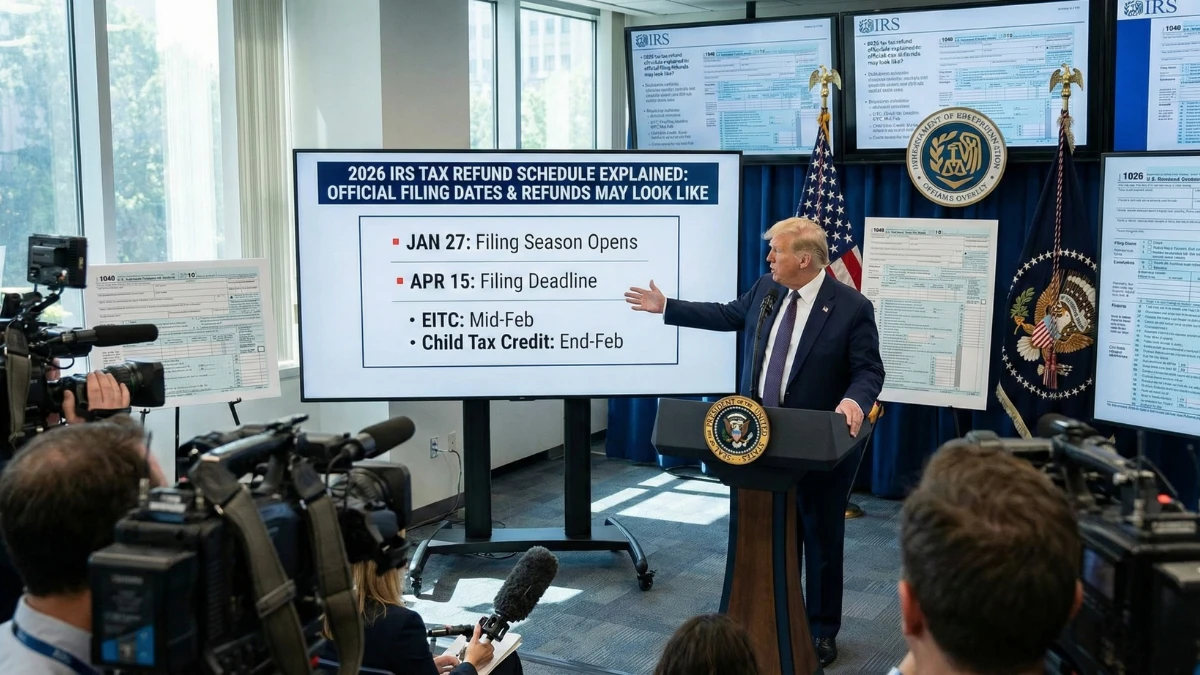

The 2026 IRS income tax refund schedule is shaping expectations for millions of filers as official filing start dates, processing rules, and verification timelines determine how soon refunds arrive and why some taxpayers may see faster—or slower—payments this tax season.

When the 2026 Tax Filing Season Officially Starts

The Internal Revenue Service opens the 2026 filing season once its systems are fully ready to accept and verify returns, which typically occurs in late January, allowing e-filed returns to enter processing even as final employer forms are still being matched.

2026 IRS Income Tax Refund Schedule Overview

| tax season event | expected timeline |

|---|---|

| w-2 forms issued | by january 31, 2026 |

| irs accepts returns | late january 2026 |

| early refunds (e-file + dd) | 10–21 days after acceptance |

| paper return refunds | 6–8 weeks or longer |

What the 2026 Refund Outlook Looks Like

Refund timing in 2026 will largely depend on filing method, return accuracy, and whether refundable credits are claimed, with e-filed returns using direct deposit continuing to receive priority over paper filings.

Why Some Refunds May Take Longer in 2026

Refunds can be delayed by W-2 mismatches, identity verification, math errors, or manual review of refundable credits, all of which pause automatic processing until issues are resolved.

Who Is Most Likely to Get Faster Refunds

Taxpayers who file early, use e-file, choose direct deposit, and submit complete, accurate returns are most likely to see faster refund delivery during the 2026 tax season.

How Filing Dates Affect Refund Planning

Filing shortly after the IRS opens acceptance can help taxpayers get in the early processing queue, but filing before all income documents arrive increases the risk of corrections that slow refunds.

Key Facts Taxpayers Should Know

- late january is the typical filing start

- direct deposit is the fastest option

- paper returns take the longest

- credits can delay processing

- accuracy matters more than speed

Conclusion

The 2026 IRS income tax refund schedule follows familiar patterns, but filing method, timing, and accuracy will define the refund outlook, making preparation and correct filing the best way to receive refunds without unnecessary delays.

Disclaimer

This article is for general informational purposes only and summarizes expected 2026 IRS filing and refund timelines; taxpayers should rely on official IRS announcements and refund tracking tools for personal refund status.